POS AM: Post-effective amendment to a registration statement that is not immediately effective upon filing

Published on July 29, 2025

As filed with the Securities and Exchange Commission on July 29, 2025

Registration No. 333-276590

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO FORM S-1 ON

Form S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ENVOY MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 86-1369123 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

4875 White Bear Lake Parkway

White Bear Lake, MN 55110

Tel: (877) 900-3277

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Brent T. Lucas

Chief Executive Officer

Envoy Medical, Inc.

4875 White Bear Lake Parkway

White Bear Lake, MN 55110

Tel: (877) 900-3277

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Andrew M. Nick

Edward M. Peilen

Fredrikson & Byron, P.A.

60 South Sixth Street, Suite 1500

Minneapolis, Minnesota 55402

Tel: (612) 492-7000

Approximate date of commencement of proposed sale to the public: From time to time after the effectiveness of the Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ | Smaller reporting company þ | Emerging growth company þ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

On January 18, 2024, the registrant initially filed a registration statement with the Securities and Exchange Commission (the “Commission”) on Form S-1 (Registration No. 333-276590), which was declared effective by the Commission on May 2, 2024 (the “Form S-1”), to register the issuance of up to 21,954,103 shares of Class A common stock, $0.0001 par value per shares (“Class A Common Stock”), the resale of up to 21,206,360 shares of Class A Common Stock by the Selling Securityholders named in the prospectus, and the resale of up to 3,874,394 warrants by the selling warrantholders named in the prospectus.

This Post-Effective Amendment No. 1 to Form S-1 on Form S-3 is being filed by the registrant to convert the Form S-1 into a registration statement on Form S-3, and contains an updated prospectus relating to the offering and sale of the shares that were registered for resale on the Form S-1.

All filing fees payable in connection with the registration of the shares of the common stock covered by the Form S-1 were previously paid by the registrant.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION DATED July 29, 2025 |

ENVOY MEDICAL, INC.

Up to 17,376,177 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Up to 3,588,406 Shares of Class A Common Stock Issuable Upon Conversion of Series A Preferred Stock

10,920,411 Shares of Class A Common Stock

3,209,511 Warrants

This prospectus relates to the issuance by us of up to an aggregate of 20,964,583 shares of our Class A common stock, $0.0001 par value per share (“Class A Common Stock”), consisting of:

| (i) | up to 14,166,666 shares of Class A Common Stock that are issuable upon the exercise of 14,166,666 warrants (“Public Warrants”) originally issued by our predecessor company, Anzu Special Acquisition Corp I (“Anzu”), as part of its initial public offering (“IPO”) of units at a price of $10.00 per unit, with each unit consisting of one share of Anzu Class A Common Stock and one-third of one Public Warrant; |

| (ii) | up to 3,209,511 shares of Class A Common Stock that are issuable upon the exercise of 3,209,511 warrants (“Shortfall Warrants” and, together with the Public Warrants, the “Warrants”) issued to the Meteora FPA Parties (as defined below) for no additional consideration pursuant to the Forward Purchase Agreement, dated April 17, 2023 (as amended to date, the “Forward Purchase Agreement”) by and among Anzu, Envoy Medical Corporation (“Legacy Envoy”) and Meteora Special Opportunity Fund I, LP (“MSOF”), Meteora Capital Partners, LP (“MCP”), Meteora Select Trading Opportunities Master, LP (“MSTO”) and Meteora Strategic Capital, LLC (“MSC”) (with MCP, MSOF, MSTO and MSC collectively as the “Meteora FPA Parties”); |

| (iii) | up to 1,849,276 shares of Class A Common Stock issuable upon conversion of 2,126,667 shares of our Series A Convertible Preferred Stock, par value $0.0001 per share (“Series A Preferred Stock”), held by Anzu SPAC GP I LLC (the “Sponsor”); |

| (iv) | up to 869,565 shares of Class A Common Stock issuable upon conversion of an aggregate of 1,000,000 shares of Series A Preferred Stock held by AICP III L.P., Anzu Industrial Capital Partners III, L.P. and Anzu Industrial Capital Partners III QP, L.P. (collectively, the “PIPE Investors”), each an affiliate of the Sponsor; and |

| (v) | up to 869,565 shares of Class A Common Stock issuable upon conversion of 1,000,000 shares of Series A Preferred Stock, which were issued to GAT Funding, LLC (“GAT”) in connection with the Closing in exchange for the Legacy Envoy Bridge Note (as defined below) at a price of $10.00 per share and have a conversion price of $11.50 per share. |

This prospectus also relates to the offer and sale from time to time by the Selling Securityholders named in this prospectus (each a “Selling Securityholder” and, collectively, the “Selling Securityholders”) of up to 3,209,511 Shortfall Warrants and up to 17,718,328 shares of Class A Common Stock, consisting of:

| (i) | up to 3,209,511 shares of Class A Common Stock that are issuable upon the exercise of 3,209,511 Shortfall Warrants issued to the Meteora FPA Parties for no additional consideration pursuant to the Forward Purchase Agreement; |

| (ii) | up to 1,849,276 shares of Class A Common Stock issuable upon conversion of 2,126,667 shares of Series A Preferred Stock, held by the Sponsor, which have a stated value of $10.00 per share and a conversion price of $11.50 per share; |

| (iii) | up to 869,565 shares of Class A Common Stock issuable upon conversion of an aggregate of 1,000,000 shares of Series A Preferred Stock held by the PIPE Investors, which have a stated value of $10.00 per share and a conversion price of $11.50 per share; |

| (iv) | up to 869,565 shares of Class A Common Stock issuable upon conversion of 1,000,000 shares of Series A Preferred Stock held by GAT, which have a stated value of $10.00 per share and a conversion price of $11.50 per share; |

| (v) | an aggregate of 125,000 shares of Class A Common Stock held by former directors of the Company; |

| (vi) | an aggregate of 10,795,411 shares of Class A Common Stock held by certain of Legacy Envoy’s former directors, officers and 5% or greater shareholders (collectively, the “Key Seller Stockholders”). |

We will not receive any proceeds from the sale of Shortfall Warrants or Class A Common Stock by the Selling Securityholders pursuant to this prospectus. Each Public Warrant entitles the holder thereof to purchase one share of Class A Common Stock at a price of $11.50 per share, and the Shortfall Warrant entitles the holder thereof to purchase one share of Class A Common Stock at a price of $1.50 per share, subject to adjustment. We will receive up to $167.7 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash, but not from the sale of the shares of Class A Common Stock issuable upon such exercise. We expect to use any such proceeds for general corporate purposes, which may include acquisitions and other business opportunities. As of the date of this prospectus, the Public Warrants are “out of the money”, which means that the trading price of the shares of Class A Common Stock underlying the Public Warrants is below the $11.50 exercise price of the Public Warrants. For so long as the Public Warrants remain “out of the money,” we do not expect warrantholders to exercise their warrants and, therefore, we do not expect to receive cash proceeds from any such exercise. As a result, we may need to secure additional debt or equity financing. There can be no assurance that we will be successful in acquiring additional funding at levels sufficient to fund our operations or on terms favorable to us. If we are unable to raise sufficient financing when needed or events or circumstances occur such that we do not meet our strategic plans, we may be required to reduce certain discretionary spending, be unable to develop new or enhanced production methods, or be unable to fund capital expenditures, which could have a material adverse effect on our financial position, results of operations, cash flows, and ability to achieve our intended business objectives. To the extent that the market prices of the Class A Common Stock exceeds the exercise price of the Warrants, warrantholders may exercise their Public Warrants and Shortfall Warrants, respectively, and sell the underlying Class A Common Stock, which may have negative impact on the market prices of the Class A Common Stock.

We have registered the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of their Shortfall Warrants or Class A Common Stock. The Selling Securityholders may offer, sell or distribute all or a portion of their Shortfall Warrants and Class A Common Stock publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any proceeds from the sale of Shortfall Warrants or Class A Common Stock by the Selling Securityholders pursuant to this prospectus. We provide more information about how the Selling Securityholders may sell their Shortfall Warrants and Class A Common Stock in the section entitled “Plan of Distribution.”

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Our Class A Common Stock and Public Warrants are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “COCH” and “COCHW,” respectively. On , 2025, the closing price of our Class A Common Stock was $ and the closing price for our Public Warrants was $ .

Investing in our securities involves risks. You should carefully review the risks and uncertainties described under the heading “Risk Factors” beginning on Page 7 of this prospectus, any applicable prospectus supplement or any related free writing prospectus, and in any documents incorporated by reference herein or therein before investing in our securities.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

The Selling Securityholders may sell the securities directly to or through underwriters or dealers, and also to other purchasers or through agents on a continuous or delayed basis. The names of any underwriters or agents that are included in a sale of securities to you, and any applicable commissions or discounts, will be stated in any accompanying prospectus supplement. In addition, the underwriters, if any, may over-allot a portion of the securities.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY ISACRIMINAL OFFENSE.

The date of this prospectus is , 2025.

TABLE OF CONTENTS

i

This prospectus is part of a registration statement on Form S-3 that Envoy Medical, Inc., a Delaware corporation, which is also referred to as the “Company,” “Envoy Medical,” “we,” “us,” “ourselves” and “our,” has filed with the United States Securities and Exchange Commission (the “SEC”) using a “shelf” registration procedure. Under this procedure, we may offer and sell at any time and from time to time, in one or more offerings, any combination of the securities described in this prospectus.

Any prospectus supplement may add, update, or change information contained in this prospectus. Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in any prospectus supplement. The information in this prospectus is accurate as of its date. Additional information, including our financial statements and the notes thereto, is incorporated in this prospectus by reference to our reports filed with the SEC. Therefore, before you invest in our securities, you should carefully read this prospectus and any prospectus supplement relating to the securities offered to you together with the additional information incorporated by reference in this prospectus and any prospectus supplement (including the documents described under the heading “Where You Can Find More Information” and “Documents Incorporated by Reference” in both this prospectus and any prospectus supplement).

This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, you should not place undue reliance on this information.

You should rely only on the information contained in or incorporated by reference in this prospectus or any prospectus supplement. Neither we nor the Selling Securityholders have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we, the Selling Securityholders nor anyone acting on our behalf is making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information incorporated by reference or provided in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents.

ii

This summary highlights information contained in other parts of this prospectus and in the documents we incorporate by reference. Because it is only a summary, it does not contain all of the information that you should consider before investing in our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference in this prospectus. You should read all such documents carefully, especially the risk factors and our consolidated financial statements and the related notes included or incorporated by reference in this prospectus, before deciding to buy shares of our common stock.

About the Company

We are a hearing health company focused on providing innovative medical technologies across the hearing loss spectrum. Our technologies are designed to shift the paradigm within the hearing industry and bring both providers and patients the hearing devices they desire. We are dedicated to pushing beyond the status quo to provide patients with improved access, usability, independence, and quality of life. We were founded in 1995 to create a fully implanted hearing device that leveraged the natural ear - not an artificial microphone - to pick up sound. The ear itself is an ideal way to capture sound from our environment.

To leverage the natural ear’s benefits, an implanted sensor was created to pick up incoming sound energy from the ossicular chain (i.e., the three tiny hearing bones that connect the eardrum to the cochlea). The sensor absorbs the mechanical energy from ossicular chain and turns it into a signal that can be processed, improved, and increased for a patient’s particular hearing needs.

Our first product, the Esteem Fully Implanted Active Middle Ear Implant (“Esteem FI-AMEI”), received FDA approval in 2010. The Esteem FI-AMEI remains the only FDA approved fully implanted active hearing device on the market. The Esteem FI-AMEI failed to gain commercial traction, primarily because the Centers for Medicaid and Medicare Services (“CMS”) classified it as a hearing aid and therefore not eligible for coverage. At an average total price (i.e., device and surgery) of over $25,000, very few individuals were willing or able to pay out-of-pocket for the Esteem FI-AMEI. We believe hearing aid classification is improper for the Esteem FI-AMEI and we continue to work towards having the Esteem FI-AMEI properly classified as a Fully Implanted Active Middle Ear Implant.

Despite the commercial challenges of the Esteem FI-AMEI, roughly 1,000 devices were implanted globally. Some devices were implanted in the early 2000s during clinical trials, providing us with nearly two decades of experience with its implantable sensor technology. Throughout our experience, our sensor technology proved a viable alternative to external or implanted microphones.

In late 2015, we made the decision to shift our focus from the Esteem FI-AMEI to a new product that would leverage our sensor technology and incorporate it into a cochlear implant. As a result, we have developed the investigational fully implanted Acclaim CI. We now believe we have the possibility to disrupt the cochlear implant market currently dominated by a small number of incumbents.

Our Product Candidate

Cochlear Implants - Fully Implanted vs. Partially Implanted

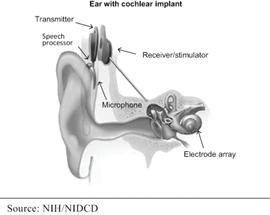

The cochlea converts vibrations from the ossicular chain into nerve signals that are transmitted through the auditory nerve for processing by the brain. Cochlear implants use electronic signals to stimulate the auditory nerve.

1

Partially implanted cochlear implants have two main components: a large external component that sits on or behind the patient’s ear and a surgically implanted internal component. The external component contains a microphone, sound processer, and batteries. A magnetic coil on the external component lines up with an internal magnetic coil in the internal component. The signal from the external component is transferred to the internal coil where it is delivered to the electrode array, which is implanted in the cochlea, to electrically stimulate the cochlea.

|

|

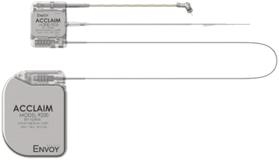

The Acclaim CI is fully implanted and does not have the need for any external component to be worn on the ear. Unlike partially implanted devices, the fully implanted Acclaim CI uses the ear to capture sound via a piezoelectric sensor that is implanted in the middle ear. The sound processor and power source are also implanted.

|

||

| CAUTION: Investigational Device – Limited by Federal (or United States) Law to Investigational Use. | ||

|

Acclaim CI - A Breakthrough Device

The fully implanted Acclaim CI received the Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA) in 2019. However, the process of medical device development is inherently uncertain and there is no guarantee that this designation will accelerate the timeline for approval or make it more likely that the Acclaim CI will be approved.

Hearing loss is currently an irreversible and debilitating human condition. Significant hearing loss is correlated with increased anxiety, depression, social isolation, falls, and other costly health issues. An article published in the journal Acta Otorhinolaryngol Italica in June 2016 suggests that untreated or undertreated hearing loss correlates with earlier loss of cognitive function and poorer cardiovascular health.1 While some solutions for hearing loss already exist (e.g., hearing aids, traditional cochlear implants) these have inherent limitations in being fully or partially external, which may limit patients in initial time to adoption, hours of use during the day (inherent compliance restrictions), lifestyle, or quality of life.

| 1 | Source: Fortunato S, et al.; A Review of New Insights on the Association Between Hearing Loss and Cognitive Decline in Ageing; Acta Otorhinolaryngologica Italica (Jun 2016), finding that increasing evidence has linked age related hearing loss to more rapid progression of cognitive decline and incidental dementia and that many aspects of daily living of elderly people have been associated to hearing abilities, showing that hearing loss affects the quality of life, social relationships, motor skills, psychological aspects and function and morphology in specific brain areas. |

2

We believe that the Acclaim CI will be able to offer hearing benefit over the patient’s baseline condition and may also offer other important advantages over alternative hearing loss treatments, such as:

| ● | Increased daily usage. We believe that the fully implanted nature of the Acclaim CI may facilitate an increase in daily usage over other types of cochlear implants because the device can be used 24-hours a day. | |

| ● | Hearing at night. Unlike other types of available cochlear implants, the Acclaim CI can be used at night. This capability may support audibility of alarms, sirens, telephones, and other people for an added sense of security while they sleep. | |

| ● | Hearing in and around water. Patients using the Acclaim CI will not need to worry about removing their device when showering, at the beach, or swimming laps. They will also not need to worry about damaging the device if caught in the rain. | |

| ● | Hearing in active situations. A patient using the Acclaim CI will not need to worry about the external processor falling off during exercise or other physical activities. The patient will not need to preemptively remove the device prior to engaging in these types of activities, thus retaining audibility of the surrounding environment. |

| ● | Lowered battery maintenance. Other cochlear implants require near-daily battery replacement or battery charging. In addition to the logistical hassle of worrying about keeping the batteries charged, this can be challenging for patients who have issues with dexterity or neuropathy, as the batteries and components are small and can be hard to handle. The Acclaim CI is designed with a battery contained within the implanted system components intended to be charged wirelessly through the skin. The Acclaim CI battery is expected to last for several days between charges and will not require the patient to use or handle small components like current cochlear implant systems do. | |

| ● | No need for backup or secondary processors. Many patients who have partially implanted cochlear implants with external hardware desire or need a backup processor. The backup processor provides the patient with a sense of security because they know if their primary processor is lost or damaged, they will be left without hearing for a period of time while they wait for a replacement. In addition, lost or damaged components can be expensive to replace, with the cost of replacement often not covered by insurance. The Acclaim CI processor is implanted and therefore not susceptible to damage, discomfort or issues associated with moisture, germs, dirt, or other external causes of loss or physical damage due to having an externally worn processor. | |

| ● | Use of equipment and accessories. The externally worn components of currently available cochlear implants can make wearing equipment or accessories difficult for existing cochlear implant patients. For example, wearing helmets, hats, headphones, stethoscopes, or other accessories can interfere with the placement of the external components and cause “coil offs” or prevent the patient from using the device altogether. | |

| ● | Earlier adoption of cochlear implant technology from reduced stigma. For many potential users of hearing instruments like hearing aids and cochlear implants, the perception of stigma associated with those technologies can prevent or delay the adoption of the technology. We believe that the Acclaim CI, with no externally worn components, may help reduce or perhaps even eliminate such stigma. We believe we can increase penetration rates for adult cochlear implants in the U.S. | |

| ● | Potential to significantly reduce overall costs while improving net healthcare outcomes. We believe a fully implanted cochlear implant could reduce cochlear implant costs over time by eliminating costly external components that are frequently replaced at the expense of the patient, the insurer, Medicare, or other third-party payor. There is also reason to believe that increasing compliance and use of cochlear implants, reducing time to adoption for candidates, and helping to support safety and security by providing the ability for true all-day hearing may improve the net healthcare outcome for society over time. |

3

The Acclaim CI is implanted by a surgeon through a procedure that we believe will average around two and a half to three hours under general anesthesia. We expect that patients may experience mild to moderate discomfort after the procedure. A four to eight week waiting period is required before the Acclaim CI can be activated to allow the middle ear to heal and fluid from surgery to dissipate. It is expected that the Acclaim CI battery pack will be replaced every 8-12 years via a less invasive surgical procedure that only replaces the Acclaim CI battery pack in the pectoral region (i.e., the whole system does not need to be replaced, just the Acclaim CI battery pack).

All of the competitive advantages referred to above require that the Acclaim CI obtain FDA approval in its current form and substantially on our planned timeline. If FDA approval is materially delayed for any reason, it is possible that competitors will offer products with similar features before we are able to market the Acclaim CI.

Business Combination

In September 2023, we completed the Business Combination pursuant to the Business Combination Agreement between Anzu and Legacy Envoy. As contemplated by the Business Combination Agreement: (a) each share of Legacy Envoy Preferred Stock issued and outstanding immediately prior to the Closing was converted into shares of Legacy Envoy Common Stock; (b) each share of Merger Sub Common Stock issued and outstanding immediately prior to the Closing was converted into and exchanged for one share of Legacy Envoy Common Stock; (c) each outstanding option to purchase shares of Legacy Envoy Common Stock outstanding as of immediately prior to the Closing was cancelled in exchange for nominal consideration; (d) each outstanding warrant to purchase shares of Legacy Envoy Common Stock outstanding as of immediately prior to the Closing automatically, depending on the applicable exercise price, was cancelled or exercised on a net exercise basis and converted into shares of Legacy Envoy Common Stock in accordance with its terms; (e) each outstanding Legacy Envoy convertible promissory note was automatically converted into shares of Legacy Envoy Common Stock in accordance with its terms; (f) each share of Legacy Envoy Common Stock issued and outstanding immediately prior to the Closing was cancelled and converted into the right to receive a number of shares of our Class A Common Stock equal to the Exchange Ratio; (g) the Sponsor forfeited 5,510,000 shares of Anzu Class B Common Stock and all 12,500,000 private warrants pursuant to the Sponsor Support Agreement; (h) the Sponsor exchanged 2,500,000 shares of Anzu Class B Common Stock for 2,500,000 shares of our Series A Preferred Stock; (i) an aggregate of 2,615,000 shares of Anzu Class B Common Stock held by the Sponsor and Anzu’s former independent directors automatically converted into our Class A Common Stock; (j) the Sponsor transferred an aggregate of 490,000 shares of our Class A Common Stock to the Legacy Forward Purchasers and the Extension Support Parties pursuant to the Side Letter Agreements and Extension Support Agreements, respectively; and (k) the Company issued an aggregate of 8,512 shares of Class A Common Stock to the Meteora FPA Parties pursuant to the Forward Purchase Agreement.

Risk Factors

Our operations and financial results are subject to various risk and uncertainties. Before deciding to invest in our securities, you should carefully consider the factors described under “Risk Factors” beginning on Page 7 of this prospectus, as well as the other information included elsewhere in this prospectus, and the risk factors described under “Part I, Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and in any subsequently-filed Quarterly Reports on Form 10-Q, and those contained in our other filings with the SEC that are incorporated by reference in this prospectus. Any of the foregoing risk factors could adversely affect our business, results of operations, financial condition and prospects. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also adversely affect our business operations.

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenues during our last fiscal year, we qualify as an emerging growth company as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in 2012. As an emerging growth company, we expect to take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion andAnalysis of Financial Condition and Results of Operations” disclosure in this prospectus; |

4

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-OxleyAct of 2002, as amended; |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; |

| ● | exemption from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We elected to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBSAct.

Implications of Being a Smaller Reporting Company

Rule 12b-2 of the Exchange Act defines a “smaller reporting company” as an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

| ● | had a public float of less than $250 million as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or |

| ● | in the case of an initial registration statement under the Securities Act, or the Exchange Act of 1934, as amended, which we refer to as the Exchange Act, for shares of its common equity, had a public float of less than $250 million as of a date within 30 days of the date of the filing of the registration statement, computed by multiplying the aggregate worldwide number of such shares held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of such shares included in the registration statement by the estimated initial public offering price of the shares; or |

| ● | in the case of an issuer whose public float as calculated under the previous two bullet points was zero or less than $700 million, had annual revenues of less than $100 million during the most recently completed fiscal year for which audited financial statements are available. |

We believe that we are a smaller reporting company, and as such that we will not be required and may not include a Compensation Discussion and Analysis section in our proxy statements; we will provide only two years of financial statements; and we need not provide the table of selected financial data. We also will have other “scaled” disclosure requirements that are less comprehensive than issuers that are not smaller reporting companies. These “scaled” disclosure requirements may make our securities less attractive to potential investors, which could make it more difficult for our security holders to sell their securities.

Corporate Information

Our principal executive office is located at 4875 White Bear Parkway, White Bear Lake, Minnesota 55110. Our telephone number is (877) 900-3277, and our website is www.envoymedical.com. The information contained on or accessible through our website is not incorporated by reference into, and should not be considered part of, this prospectus or the information incorporated herein by reference.

Where You Can Find More Information

You should rely only on the information contained in this prospectus or incorporated herein by reference. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the SEC or incorporated herein by reference. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, the common shares and pre-funded warrants only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this document, regardless of the time of delivery of this prospectus or any sale of the common shares and pre-funded warrants. Our business, financial condition, results of operations, and prospects may have changed since the date hereof.

5

THE OFFERING

| Issuer | Envoy Medical, Inc. | |

| Common Shares Offered by the Selling Securityholders | Up to 17,718,328 shares of Class A Common Stock | |

| Common Shares Outstanding | 21,520,392 sharse of Class A Common Stock | |

| Use of Proceeds | We will use any proceeds from the exercise of the Warrants for general corporate purposes. We will not receive any proceeds from the sale of the common shares being offered for sale by the Selling Securityholders. | |

| Plan of Distribution | The Selling Securityholders may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. Registration of the common stock covered by this prospectus does not mean, however, that such shares necessarily will be offered or sold. See the section entitled “Plan of Distribution.” | |

| Dividend Policy | We have paid no dividends on the common shares to date, and we do not expect to pay dividends on our common shares in the foreseeable future. | |

| Listing and Trading Symbol | Our Class A Common Stock and Public Warrants are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “COCH” and “COCHW,” respectively. | |

| TransferAgent and Registrar | Equiniti Trust Company, LLC. | |

| Risk Factors | You should carefully read and consider the information set forth under the heading “Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common shares, pre-funded warrants, and warrants. |

The number of shares of our common stock to be outstanding is based on 21,520,392 shares of Class A Common Stock outstanding as of July 28, 2025 and excludes as of such date:

| ● | 14,166,666 shares of Class A Common Stock issuable upon exercise of the Public Warrants with an exercise price of $11.50 per share; |

| ● | 3,209,511 shares of Class A Common Stock issuable upon exercise of the Meteora Warrants with an exercise price of $1.50 per share, subject to adjustment; |

| ● | 3,500,000 shares of Class A Common Stock issuable upon exercise of the warrants held by GAT with a weighted average exercise price of $1.90 per share; |

| ● | 3,209,511 shares of Class A Common Stock issuable upon conversion of Series A Preferred Stock; and |

| ● | 2,164,238 shares of Class A Common Stock underlying options granted under our 2023 Equity Incentive Plan, exercisable at an average weighted exercise price of $2.32 per share. |

Unless otherwise indicated, all information in this prospectus assumes no exercise of the underwriters’ option to purchase additional securities from us and that no investor elects to purchase pre-funded warrants in lieu of common shares.

6

Investing in our securities involves risk. You should consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 filed on March 31, 2025 with the Securities and Exchange Commission (“SEC”), which is incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. See “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. If any of these risks were to occur, our business, financial condition, and results of operations could be severely harmed. This could cause the trading price of our common stock to decline, and you could lose all or part of your investment.

7

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and the documents incorporated herein by reference contain forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities Act”, and Section 21E of the Exchange Act, which are subject to the safe harbor created by those sections. These forward-looking statements and information regarding us, our business prospects and our results of operations are subject to certain risks and uncertainties that could cause our actual business, prospects and results of operations to differ materially from those that may be anticipated by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those described under “Risk Factors” herein and in our other filings with the SEC. You should not place undue reliance on these forward-looking statements. You should assume that the information contained in or incorporated by reference in this prospectus, and any prospectus supplement, is accurate only as of the date on the front cover of this prospectus, and any prospectus supplement, or as of the date of the documents incorporated by reference herein or therein, as applicable. We expressly disclaim any intent or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are urged to carefully review and consider the various disclosures made by us in this prospectus, any prospectus supplement and the documents incorporated herein by reference and in our other reports filed with the SEC that advise interested parties of the risks and uncertainties that may affect our business.

All statements, other than statements of historical facts, contained in this prospectus, any prospectus supplement and the documents incorporated herein by reference, including statements regarding our plans, objectives and expectations for our business, operations and financial performance and condition, are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “target,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our results, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this prospectus, any prospectus supplement and the documents incorporated herein by reference. Additionally, our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make. Forward-looking statements may include, among other things, statements relating to:

| ● | our financial performance; |

| ● | changes in the market price of our Class A Common Stock; |

| ● | unpredictability in the medical device industry, the regulatory process to approve medical devices, and the clinical development process of our products; |

| ● | the potential need to make design changes to products to meet desired safety and efficacy endpoints; |

| ● | changes in federal or state reimbursement policies that would adversely affect sales of our products; |

8

| ● | introduction of other scientific advancements, including gene therapy or pharmaceuticals, that may impact the need for hearing devices such as cochlear implants or fully implanted active middle ear implants; |

| ● | competition in the medical device industry, and the failure to introduce new products and services in a timely manner or at competitive prices to compete successfully against competitors; |

| ● | disruptions in relationships with our suppliers, or disruptions in our own production capabilities for some of the key components and materials of our products; |

| ● | changes in the need for capital and the availability of financing and capital to fund these needs; |

| ● | changes in interest rates or rates of inflation; |

| ● | legal, regulatory and other proceedings that could be costly and time-consuming to defend; |

| ● | changes in applicable laws or regulations, or changes in how such laws or regulations are applied to us; |

| ● | loss of any of our key intellectual property rights or failure to adequately protect intellectual property rights; |

| ● | our ability to maintain the listing of our securities on the Nasdaq Stock Market; |

| ● | the effects of catastrophic events, including war, terrorism and other international conflicts; and |

| ● | other risks and uncertainties indicated in this prospectus, including those set forth under the section entitled “Risk Factors.” |

Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. Nothing in this prospectus should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on these forward-looking statements. We do not undertake any duty to update these forward-looking statements, except as required by law.

In addition, statements that “we believe”

and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available

to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information

may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or

review of, all relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these

statements.

9

We will receive up to an aggregate of approximately $167.7 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds, if any, from the exercise of the Warrants for general corporate purposes, which may include acquisitions and other business opportunities. We will have broad discretion over the use of proceeds from the exercise of the Warrants. There is no assurance that the holders of the Warrants will elect to exercise any or all of such Warrants. To the extent that any Public Warrants are exercised on a “cashless basis,” we would not receive any cash proceeds from the exercise of such Public Warrants.

As of the date of this prospectus, the Public Warrants are “out of the money,” which means that the trading price of the shares of our Class A Common Stock underlying our Warrants, which was $ per share on , 2025, is below (i) the $11.50 exercise price (subject to adjustment as described herein) of the Public Warrants. For so long as the Public Warrants remain “out of the money,” we do not expect warrantholders to exercise their warrants and, therefore, we do not expect to receive cash proceeds from any such exercise.

We will not receive any proceeds from the issuance of Class A Common Stock upon conversion of Series A Preferred Stock.

All of the Shortfall Warrants and shares of Class A Common Stock offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from these sales.

10

We are registering the issuance by us of up to an aggregate of 20,964,583 shares of Class A Common Stock, consisting of (i) up to 14,166,666 shares of Class A Common Stock issuable upon the exercise of the Public Warrants by the holders thereof, (ii) up to 3,209,511 shares of Class A Common Stock issuable upon the exercise of 3,209,511 Shortfall Warrants and (iii) up to 3,588,406 shares of Class A Common Stock issuable upon conversion of 4,126,667 shares of Series A Preferred Stock. We are also registering the resale by the Selling Securityholders or their permitted transferees from time to time of up to 3,874,394 Shortfall Warrants and up to 17,718,328 shares of Class A Common Stock, consisting of (i) up to 3,588,406 shares of Class A Common Stock issuable upon conversion of 4,126,667 shares of Series A Preferred Stock, (ii) up to 3,209,511 shares of Class A Common Stock issuable upon the exercise of 3,209,511 Shortfall Warrants and (iii) up to 10,920,411 outstanding shares of Class A Common Stock. We are required to pay all fees and expenses incident to the registration of the Shortfall Warrants and shares of our Class A Common Stock to be offered and sold pursuant to this prospectus. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of Shortfall Warrants and shares of Class A Common Stock.

We will receive proceeds from the Warrants in the event that such Warrants are exercised for cash. We will not receive any of the proceeds from the sale of Shortfall Warrants or shares of Class A Common Stock by the Selling Securityholders. The aggregate proceeds to the Selling Securityholders will be the purchase price of the securities less any discounts and commissions borne by the Selling Securityholders. The term “Selling Securityholder” includes donees, pledgees, transferees or other successors in interest selling securities received after the date of this prospectus from the Selling Securityholders as a gift, pledge, partnership distribution or other transfer. The Selling Securityholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices related to the then current market price or in negotiated transactions. The Selling Securityholders may sell their Shortfall Warrants and shares of Class A Common Stock by one or more of, or a combination of, the following methods:

| ● | purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

| ● | ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| ● | block trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | an over-the-counter distribution in accordance with the rules of Nasdaq; |

| ● | through trading plans entered into by the Selling Securityholders pursuant to Rule 10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans; |

| ● | to or through underwriters or broker-dealers; |

11

| ● | in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

| ● | in privately negotiated transactions; |

| ● | in options transactions; |

| ● | through a combination of any of the above methods of sale; or |

| ● | any other method permitted pursuant to applicable law. |

In addition, any shares that qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In connection with distributions of the shares or otherwise, the Selling Securityholders may enter into hedging transactions with broker-dealers or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of Shortfall Warrants and shares of Class A Common Stock in the course of hedging the positions they assume with the Selling Securityholders. The Selling Securityholders may also sell Shortfall Warrants and shares of Class A Common Stock short and redeliver the shares to close out such short positions. The Selling Securityholders may also enter into option or other transactions with broker-dealers or other financial institutions which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The Selling Securityholders may also pledge shares to a broker-dealer or other financial institution, and, upon a default, such broker-dealer or other financial institution, may effect sales of the pledged shares pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Securityholders may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If an applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by the Selling Securityholders or borrowed from the Selling Securityholders or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from the Selling Securityholders in settlement of those derivatives to close out any related open borrowings of stock. If applicable through securities laws, the third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, the Selling Securityholders may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

In effecting sales, broker-dealers or agents engaged by the Selling Securityholders may arrange for other broker-dealers to participate. Broker-dealers or agents may receive commissions, discounts or concessions from the Selling Securityholders in amounts to be negotiated immediately prior to the sale.

In offering the securities covered by this prospectus, the Selling Securityholders and any broker-dealers who execute sales for the Selling Securityholders may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. Any profits realized by the Selling Securityholders and the compensation of any broker-dealer may be deemed to be underwriting discounts and commissions.

In order to comply with the securities laws of certain states, if applicable, the securities must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the securities may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

We have advised the Selling Securityholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of securities in the market and to the activities of the Selling Securityholders and their affiliates. In addition, we will make copies of this prospectus available to the Selling Securityholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Securityholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

At the time a particular offer of securities is made, if required, a prospectus supplement will be distributed that will set forth the number of securities being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

A holder of Public Warrants may exercise its Public Warrants in accordance with the Warrant Agreement, on or before the expiration date set forth therein by surrendering, at the office of the Warrant Agent, the certificate evidencing such Public Warrant, with the form of election to purchase set forth thereon, properly completed and duly executed, accompanied by full payment of the exercise price and any and all applicable taxes due in connection with the exercise of a Public Warrant, subject to any applicable provisions relating to cashless exercises in accordance with the Warrant Agreement.

12

The Selling Securityholders may from time to time offer and sell any or all of the Shortfall Warrants and shares of Class A Common Stock set forth below pursuant to this prospectus. When we refer to the “Selling Securityholders” in this prospectus, we mean the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the Selling Securityholders’ interest in the Shortfall Warrants or shares of Class A Common Stock after the date of this prospectus such that registration rights shall apply to those securities.

Pursuant to agreements with the Selling Securityholders, we agreed to file a registration statement with the SEC for the purposes of registering the Shortfall Warrants and Class A Common Stock for resale. The shares of Class A Common Stock being offered by the Selling Securityholders consist of (i) up to 3,588,406 shares of Class A Common Stock issuable upon the conversion of 4,126,667 shares of Series A Preferred Stock pursuant to the Certificate of Designation, (ii) up to 3,209,511 shares of Class A Common Stock issuable upon the exercise of 3,209,511 Shortfall Warrants and (iii) up to 10,920,411 outstanding shares of Class A Common Stock.

Given the current market price of our Class A Common Stock, certain of the Selling Securityholders who paid less for their shares than such current market price will receive a higher rate of return on any such sales than the public securityholders who purchased their Class A Common Stock in the IPO or any Selling Securityholder who paid more for their shares than the current market price.

The following tables are prepared based on information provided to us by the Selling Securityholders. It sets forth the name of each Selling Securityholder, the aggregate number of Shortfall Warrants and shares of Class A Common Stock that each Selling Securityholder may offer pursuant to this prospectus, and the beneficial ownership of each Selling Securityholder both before and after the offering. We have based percentage ownership prior to this offering on 21,520,932 shares of Class A Common Stock outstanding as of July 25, 2025. In calculating percentages of shares of Class A Common Stock owned by a particular Selling Securityholder, we treated as outstanding the number of shares of our Class A Common Stock issuable upon exercise of that particular Selling Securityholder’s Shortfall Warrants and conversion of that particular Selling Securityholder’s Series A Preferred Stock, if any, and did not assume the exercise of any other Selling Securityholders’ Shortfall Warrants or conversion of any other Selling Securityholders’ Series A Preferred Stock.

13

We cannot advise you as to whether the Selling Securityholders will in fact sell any or all of such Shortfall Warrants or shares of Class A Common Stock. In addition, the Selling Securityholders may sell, transfer or otherwise dispose of, at any time and from time to time, the Shortfall Warrants or Class A Common Stock in transactions exempt from the registration requirements of the Securities Act after the date of this prospectus, subject to the restrictions on transfer described above. For purposes of this table, we have assumed that the Selling Securityholders will have sold all of the securities covered by this prospectus upon the completion of the offering.

| Beneficial Ownership Before the Offering |

Securities to be Sold in the Offering |

Beneficial Ownership After the Offering |

||||||||||||||||||||||||||||||||||

| Name of Selling Securityholder | Shares of Class A Common Stock |

% | Shortfall Warrants |

Shares of Class A Common Stock |

% | Shortfall Warrants |

Shares of Class A Common Stock |

% | Shortfall Warrants |

|||||||||||||||||||||||||||

| Glen A. Taylor(1) | 13,909,614 | 55.3 | % | — | 11,159,614 | 44.4 | % | — | 2,750,000 | 10.9 | % | — | ||||||||||||||||||||||||

| Anzu SPAC GP I LLC(2) | 2,718,841 | 11.2 | % | — | 2,718,841 | 11.2 | % | — | 0 | * | — | |||||||||||||||||||||||||

| Brent T. Lucas(3) | 1,116,081 | 4.9 | % | — | 118,958 | * | — | 997,123 | 4.4 | % | — | |||||||||||||||||||||||||

| Allen Lenzmeier(4) | 163,642 | * | — | 163,642 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Paul Waldon(5) | 222,762 | * | — | 222,762 | * | — | * | — | ||||||||||||||||||||||||||||

| Daniel J. Hirsch(6) | 25,000 | * | — | 25,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Priya Cherian Huskins(7) | 25,000 | * | — | 25,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Susan J. Kantor(8) | 140,387 | * | — | 25,000 | * | — | 115,387 | * | — | |||||||||||||||||||||||||||

| Diane L. Dewbrey(9) | 25,000 | * | — | 25,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Teresa A. Harris(10) | 25,000 | * | — | 25,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Arena Capital Advisors(11) | 45,000 | * | — | 45,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Entities Affiliated with Fir Tree Capital Management, LP(12) | 125,000 | * | — | 125,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Entities Affiliated with Sandia Investment Management LP(13) | 100,000 | * | — | 100,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Entities Affiliated with Weiss Asset Management LP(14) | 20,000 | * | — | 20,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| SZOP Multistrat LP(15) | 20,000 | * | — | 20,000 | * | — | 0 | * | — | |||||||||||||||||||||||||||

| Polar Multi-Strategy Master Fund(16) | 648,771 | 3.3 | % | — | 80,000 | * | — | 568,771 | 2.9 | % | — | |||||||||||||||||||||||||

| Entities Affiliated with Meteora Capital, LLC(17) | 3,743,629 | 9.99 | % | 3,209,511 | 3,743,629 | 9.9 | % | 3,209,511 | 0 | * | — | |||||||||||||||||||||||||

| * | Less than one percent. |

| (1) | Includes (i) 2,953,607 shares of Class A Common Stock held by Mr. Taylor directly, (ii) 2,526,058 shares of Class A Common Stock held by Taylor Sports Group of which Mr. Taylor is the owner and chairman, (iii) 4,810,384 shares of Class A Common Stock held by GAT Funding, LLC, which Mr. Taylor controls and (iv) 869,565 shares of Class A Common Stock issuable upon the conversion of 1,000,000 shares of Series A Preferred Stock, which were issued to GAT Funding, LLC pursuant to the Legacy Envoy Medical Bridge Note. Mr. Taylor served as a member of the Legacy Envoy Board prior to the Business Combination and now serves as a member of the board of directors of the Company. |

| (2) | Includes (i) 1,849,276 shares of Class A Common Stock issuable upon the conversion of 2,126,667 shares of Series A Preferred Stock received by Anzu GP in a private exchange offer for shares of Anzu Class B Common Stock and (ii) 869,565 shares of Class A Common Stock issuable upon the conversion of an aggregate of 1,000,000 shares of Series A Preferred Stock, which were issued to AICP III L.P., Anzu Industrial Capital Partners III, L.P. and Anzu Industrial Capital Partners III QP, L.P., each an affiliate of Anzu GP. Whitney Haring-Smith, David Seldin and David Michael share voting and investment control over shares held by Anzu GP by virtue of their shared control of Anzu GP. The business address of Anzu GP is 12610 Race Track Road, Suite 250 Tampa, FL 33626. |

| (3) | Includes (i) 200,780 shares of Class A Common Stock held directly by Mr. Lucas, (ii) 800,327 shares of Class A Common Stock issuable upon exercise of stock options, (iii) 110,987 shares of Class A Common Stock issuable upon exercise of Public Warrants, (iv) 1,972 shares of Class A Common Stock held by Mr. Lucas’s spouse, (v) 5,991 shares of Class A Common Stock held by the Brent T. Lucas Irrevocable Trust of which Mr. Lucas is a beneficiary, and (vi) 12,720 shares of Class A Common Stock held by the Brent T. Lucas Family Education Trust of which Mr. Lucas’ children are beneficiaries and Mr. Lucas is a trustee. |

| (4) | Includes (i) 159,190 shares of Class A Common Stock held by Allen U. Lenzmeier and Kathleen Lenzmeier, Trustees of the Allen U. Lenzmeier Revocable Trust U/A dtd 11/29/2012 and (ii) 4,452 shares of Class A Common Stock held by Allen Lenzmeier and Kathleen Lenzmeier, JTWROS. Allen Lenzmeier previously served as a member of the Legacy Envoy Board. |

14

| (5) | Includes (i) 1,170 shares of Class A Common Stock held directly by Paul Waldon and (ii) 221,592 shares of Class A Common Stock held by Carefree Capital, Inc. Mr. Waldon previously served as a member of the Legacy Envoy Board. |

| (6) | Daniel J. Hirsch previously served as a member of the board of directors and as Chief Financial Officer and Corporate Secretary of Anzu. |

| (7) | Priya Cherian Huskins previously served as a member of the board of directors of Anzu. |

| (8) | Susan J. Kantor previously served as a member of the board of directors of Anzu prior to the Business Combination and now serves as a member of the board of directors of the Company. Includes stock options to purchase 62,5000 shares of Class A Common Stock. |

| (9) | Diane L. Dewbrey previously served as a member of the board of directors of Anzu. |

| (10) | Teresa A. Harris previously served as a member of the board of directors of Anzu. |

| (11) | Arena Capital Advisors, LLC is the general partner of Arena Capital Advisors and may be deemed to have voting control and investment discretion over the securities. The partners of Arena Capital Advisors, LLC are Daniel Elperin, Jeremy Sagi and Sanije Perrett, and as such Mr. Elperin, Mr. Sagi and Mr. Perrett may be deemed to beneficially own the securities. |

| (12) | Includes (i) 15,217 shares of Class A Common Stock held directly by Fir Tree Capital Opportunity Master Fund, LP, (ii) 22,997 shares of Class A Common Stock held directly by Fir Tree Capital Opportunity Master Fund III, LP, (iii) 32,087 shares of Class A Common Stock held directly by FT SOF XIII (SPAC) Holdings, LLC, (iv) 24,226 shares of Class A Common Stock held directly by Fir Tree Value Master Fund, LP and (v) 30,473 shares of Class A Common Stock held directly by Boston Patriot Merrimack St LLC (collectively, the “Fir Tree Funds”). Fir Tree Capital Management, LP is the Investment Manager of the Fir Tree Funds and has sole investment and dispositive power over the shares held thereby. Clinton Biondo and David Sultan are Managing Partners of Fir Tree Capital Management, LP and may be deemed to have voting and investment control with respect to the shares held by these entities. Each of the parties in this footnote disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest the party may have therein. |

| (13) | Includes shares of Class A Common Stock allocated to investors managed by Sandia Investment Management LP (“Sandia”). Tim Sichler serves as Founder & CIO of the general partner of Sandia, and in such capacity may be deemed to be the beneficial owner having shared voting power and shared investment power over the securities described in this footnote. Each of the parties in this footnote disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest the party may have therein. The business address of these entities and Mr. Sichler is 201 Washington Street, Boston, Massachusetts 02108. |

| (14) | Includes (i) 7,400 shares of Class A Common Stock held directly by Brookdale Global Opportunity Fund (“BGO”) and (ii) 12,600 shares of Class A Common Stock held directly by Brookdale International Partners, L.P. (“BIP”). Andrew Weiss is the Manager of WAM GP LLC, which is the general partner of Weiss Asset Management LP, the investment manager of BGO and BIP. WAM GP LLC is also the Manager of BIP GP LLC, the general partner of BIP. Mr. Weiss has voting and dispositive power with respect to the securities held by the BGO and BIP. Mr. Weiss, WAM GP LLC, Weiss Asset Management LP and BIP GP LLC each disclaim beneficial ownership of the shares held by BGO and BIP, except to the extent of their respective pecuniary interests therein. |

| (15) | SZOP Multistrat Management LLC (the “SZOP Manager”) serves as the investment manager to SZOP Multistrat LP. Antonio Ruiz-Gimenez and Kerry Propper serve as managing members of the SZOP Manager (all of the foregoing, collectively, the “SZOP Reporting Persons”). The SZOP Reporting Persons may be deemed to have shared voting and dispositive power with respect to the shares of Class A Common Stock owned by SZOP Multistrat LP. |

| (16) | Polar Multi-Strategy Master Fund (the “Polar Fund”) is under management by Polar Asset Management Partners Inc. (“PAMPI”). PAMPI serves as Investment Advisor to the Polar Fund and has control and discretion over the securities held by the Polar Fund. As such, PAMPI may be deemed the beneficial owner of the securities held by the Polar Fund. PAMPI disclaims any beneficial ownership of the reported securities other than to the extent of any pecuniary interest therein. The ultimate natural persons who have voting and dispositive power over the securities held by the Polar Fund are Paul Sabourin and Abdalla Ruken, Co-Chief Investment Officers of PAMPI. |

| (17) | Includes (i) 28,416 shares of Class A Common Stock held directly by Meteora Capital Partners, LP, (ii) 20,425 shares of Class A Common Stock held directly by Meteora Select Trading Opportunities Master, LP, (iii) 9,453 shares of Class A Common Stock held directly by Meteora Special Opportunity Fund I, LP, (iv) 1,030 shares of Class A Common Stock held directly by Meteora Strategic Capital, LLC, (v) 3,874,394 shares of Class A Common Stock issuable upon the exercise of the Shortfall Warrants held directly by the Meteora FPA Parties, (vi) 26,142 shares of Class A Common Stock held directly by Boothbay Absolute Return Strategies, LP and (vii) 23,046 shares of Class A Common Stock held directly by Boothbay Diversified Alpha Master Fund, LP (collectively, the “Meteora Funds”). Meteora Capital, LLC serves as investment manager to the Meteora Funds. Vik Mittal serves as the Managing Member of Meteora Capital, LLC. (collectively, the “Meteora Funds”). Meteora Capital, LLC serves as investment manager to the Meteora Funds. Vik Mittal serves as the Managing Member of Meteora Capital, LLC. The Meteora FPA Parties are subject to a blocker which prevents them from exercising their Shortfall Warrants to the extent that, upon such exercise, the Meteora Funds would collectively beneficially own in excess of 9.99% of shares of Class A Common Stock outstanding as a result of the exercise. |

15

DESCRIPTION OF PRIVATE PLACEMENTS

Description of 2023 PIPE Private Placements

The following description is qualified in its entirety by the terms and conditions of the Subscription Agreement and Convertible Promissory Note, which are included as Exhibit 10.1 and Exhibit 10.2 hereto, respectively, and incorporated by reference into the registration statement of which this prospectus forms a part. The following description may not contain all the information with respect to the Subscription Agreement and Convertible Promissory Note that is important to you. We encourage you to read the Subscription Agreement and Convertible Promissory Note in their entirety.

Pursuant to the Subscription Agreement, dated April 17, 2023 (as amended to date, the “Subscription Agreement”), by and between Anzu and Sponsor, the Company issued, and certain affiliates of the Sponsor purchased, concurrently with the Closing, an aggregate of 1,000,000 shares of Series A Preferred Stock in a private placement at a price of $10.00 per share for an aggregate purchase price of $10,000,000.

Pursuant to the Convertible Promissory Note, dated April 17, 2023, between Legacy Envoy and GAT, the Company issued 1,000,000 shares of Series A Preferred Stock to GAT Funding, LLC concurrently with the Closing.

Registration Rights

We are required to maintain the effectiveness of the registration statement of which this prospectus forms a part until the shares Class A Common Stock issued upon conversion of the shares of Series A Preferred Stock issued in the 2023 PIPE Private Placement are sold.

Description of 2023 Warrant Private Placement

The following description is qualified in its entirety by the terms and conditions of the Forward Purchase Agreement, which is included as Exhibit 10.3 hereto and incorporated by reference into the registration statement of which this prospectus forms a part. The following description may not contain all the information with respect to the Forward Purchase Agreement that is important to you. We encourage you to read the Forward Purchase Agreement in their entirety.

Pursuant to the terms of the Forward Purchase Agreement, dated April 17, 2023 (as amended to date, the “Forward Purchase Agreement”), by and between Anzu, Legacy Envoy, and the Meteora FPA Parties Sponsor, the Company issued 3,874,394 Shortfall Warrants, of which 3,209,511 remaining outstanding. The currently outstanding Shortfall Warrants are exercisable for 3,209,511 shares of Class A Common Stock at an exercise price of $1.50 per share, subject to adjustment.

Pursuant to the Convertible Promissory Note, dated April 17, 2023, between Legacy Envoy and GAT, the Company issued 1,000,000 shares of Series A Preferred Stock to GAT Funding, LLC concurrently with the Closing.

Registration Rights

We are required to maintain the effectiveness of the registration statement of which this prospectus forms a part until the shares Class A Common Stock issued upon exercise of the Shortfall Warrants are sold.

16

The following summary of the material terms of our securities is not intended to be a complete summary of the rights and preferences of such securities, and is qualified by reference to our Certificate of Incorporation, our Bylaws and the Warrant-related documents described herein, which are exhibits to the registration statement of which this prospectus is a part. We urge you to read each of our Certificate of Incorporation, the Bylaws and the Warrant-related documents described herein in their entirety for a complete description of the rights and preferences of our securities.

Authorized and Outstanding Stock